Intel

Please type in your search term to see articles.

Hailstorm Risks Intensify, Driving Homeowners Insurance Shifts

Inside This Article: Hailstorms are a growing threat in the U.S. and Canada, causing more frequent and severe losses for homeowners. One record-breaking hailstorm in Calgary generated 130,000 claims and nearly $2.8 billion in losses. Property damage caused by hail can be covered by Homeowners Insurance, but separate wind and hail deductibles typically apply. Percentage-based deductibles and roof settlement…

Unexpected Freeze Leads to Costly Home Repairs from Burst Pipes

Inside This Article Water damage is Canada\'s leading cause of home insurance claims, accounting for about half of all claims. Preventative measures like insulating pipes, maintaining indoor heat, and installing automatic water shutoff devices can help reduce the risk of costly damage. Homeowners should review their insurance policies and consult an experienced broker to understand coverage limitations and avoid…

Unoccupied Homes Becoming ‘Hotspot’ for Squatters, Fires, Thefts and More

Incidents involving vacant homes are on the rise in Terre Haute, Indiana, especially amid frigid winter weather, as empty homes in the city are increasingly being used for shelter, drugs or theft, WTWO News reported recently. The trend is mirrored in other parts of North America. For example, an uptick in fires at vacant properties in Albany, New York, is…

P&C Report: 2025 Forecast

OVERVIEW California Wildfires While this report highlights the growth in E&S policies and other trends in the Property & Casualty (P&C) sector as we enter 2025, we must first address the devastating wildfires in southern California, which have significantly impacted the industry and local communities. Current estimates suggest these wildfires have caused $25…

Webinar: Eye on 2025: Navigating the Evolving E&S Insurance Landscape

The wildfires in Southern California have deeply affected countless individuals, underscoring the devastating consequences of severe weather conditions. Our thoughts are with those impacted and the first responders working tirelessly to safeguard lives and communities. In our regularly scheduled Eye on 2025: Property and Casualty (P&C) webinar, our expert panel expressed their support for those affected by the wildfires and…

Tricks on Backyard Trampoline Lead to Injury, Heartbreak for Father

A man in Twin Falls, Idaho, suffered debilitating injuries from a terrible accident earlier this year after jumping and attempting tricks on a trampoline with his son at a friend\'s backyard barbecue, KMVT reported in November. “The incident is a heartbreaking story,” said Jeremy Bright, Underwriter, Personal Insurance, Burns & Wilcox, Atlanta, Georgia. “In the insurance…

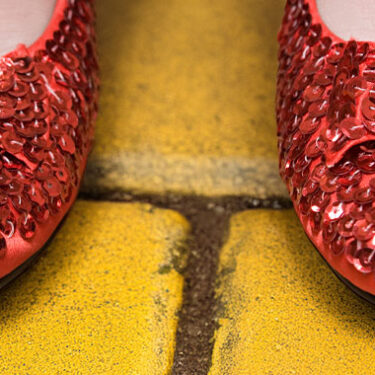

$32.5M Ruby Slippers Smash Auction Records Amid ‘Wicked’ Buzz

A pair of ruby slippers worn by Judy Garland in The Wizard of Oz recently became the most valuable movie memorabilia ever sold at auction, fetching $32.5 million in the Heritage Auctions sale that closed Dec. 7. The iconic shoes were sold alongside the hat worn by the Wicked Witch in the 1939 film; the hat sold for $2.9 million,…

Webinar: Solutions for Residential Properties

The E&S market is transforming, and Residential Property risks are finding a new home in the non-admitted space. Watch the recording of “The E&S Evolution: Solutions for Residential Properties” to gain expert insights into the trends reshaping the industry. Learn strategies to: Secure tailored solutions Navigate challenges Elevate your client service Panelists: Heather Posner, Vice President, National Product Leader, Private…

Short-Term Rental Risks: Airbnb Owner Seeks $540,000, Citing ‘Bizarre’ Damage

The owner of an Airbnb in Ithaca, New York, is suing Cornell University and the vacation rental platform in a lawsuit that claims a group of international students who rented her home caused $200,000 in severe and \"bizarre\" damages during their eight-day stay. In the lawsuit, the owner alleges that the exchange students — reportedly “hand-picked” for a summer program…

P&C Report: 2024 Q4 Outlook

Last quarter, we indicated the Property & Casualty (P&C) market had reached a relative level of equilibrium not seen in several years. We defined this as an environment where rates and capacity were relatively stable, and carriers could be profitable. The gradual and consistent shift in business from the admitted to the Excess & Surplus (E&S) market is a transformation…

Video: Residential Property Insurance Market Update

In our latest P&C webinar, Pamela Alphabet, Associate Vice President, Regional Practice Group Leader, Personal Insurance, Burns & Wilcox, Scottsdale, Arizona, discussed what is driving the hard market and ways to secure coverage. https://vimeo.com/1020710933/6d578c97e7?share=copy Want more information? You can watch the entire webinar here.

Webinar: P&C Market Outlook Q4 2024

While we are experiencing more stabilization, some hard sectors remain as carriers continue to revise their appetites. Watch our P&C webinar for insights into the current state of the market, what is expected for the rest of the year and what 2025 may hold. Highlights include: The increasing role of dynamic pricing in Personal Insurance Why some admitted carriers are…

Powered by